Managing money can often feel like a juggling act—bills, savings, debt, and lifestyle choices all competing for your paycheck. Traditional budgeting systems can be too rigid, while “winging it” with spending often leads to stress and financial insecurity. That’s why percentage-based budget frameworks have gained...

New Admin

From Budgeting on a Low Income to Building Wealth: A Complete Guide

Financial freedom isn’t about luck—it’s about strategy. Whether you’re drowning in debt, just starting to invest, or want to understand the many ways to earn money, this guide is your roadmap. We’ll cover how to quickly pay off debt, how to invest your first $1,000,...

From Budgeting on a Low Income to Building Wealth: A Complete Guide

Most of us grow up with one lesson drilled into our heads: work hard, earn money, and spend carefully. But here’s the truth — earning money is only the first step in financial success. The real journey begins with learning how to budget wisely and...

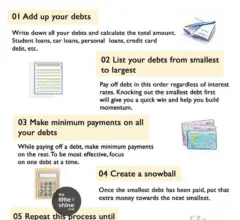

How to Pay Off Debt Quickly?

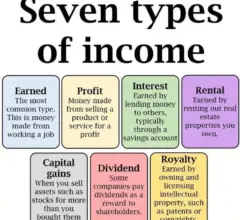

Money has two sides: how you earn it and how you manage it. Most people only focus on the first part — they work hard for a paycheck, hoping it will be enough. But the truth is, relying on just one income stream (usually earned...

Mastering the 7 Types of Income and the Debt Snowball Strategy

Most of us grow up with one lesson drilled into our heads: work hard, earn money, and spend carefully. But here’s the truth — earning money is only the first step in financial success. The real journey begins with learning how to budget wisely and...

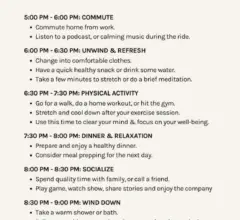

The 5–9 PM After Work Routine Planner for Personal Development

Most people spend their mornings rushing to work and their nights collapsing into bed — with little thought about the in-between time. We often hear advice about powerful morning routines, but the truth is, your after-work hours — the 5 to 9 PM window —...

The 7 Types of Income: A Complete Guide to Building Wealth

Most people grow up with one idea about money: you go to school, get a job, and earn a paycheck. That’s what we call earned income—and while it’s the most common type, it’s also the most limiting. Wealthy people think differently. They don’t just work...

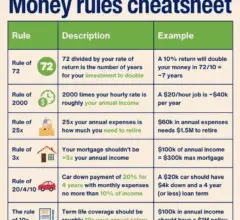

The Ultimate Money Rules Cheatsheet: 7 Simple Rules to Master Your Finances

Money can feel overwhelming. Between investments, retirement accounts, mortgages, insurance policies, and the endless advice online, it’s no wonder many people freeze up when it comes to managing their finances. But here’s the good news: you don’t need to be a Wall Street pro to...

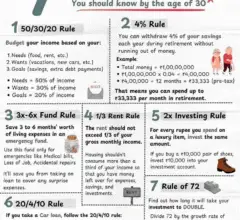

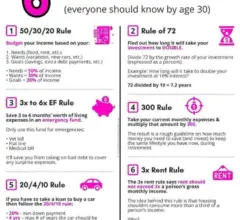

6 Finance Rules Everyone Should Know by Age 30

Money doesn’t come with an instruction manual. Most of us grow up learning math, science, and history—but very few of us are taught how to manage money. That’s why so many people enter adulthood unprepared, making expensive mistakes that can take years (or even decades)...

Stop Budgeting Like the Middle Class: How Millionaires Actually Manage Money

Part 1: The Psychology Behind Budgeting When most people think about budgeting, they picture spreadsheets, calculators, or a mobile app that nags them every time they grab a latte. But at its core, budgeting isn’t really about numbers — it’s about priorities and psychology. If...